Is Buying A Home Still A Good Investment?

We get it. Going to the grocery store feels like a massive financial commitment these days. For some people, buying a home can feel overwhelming and maybe even impossible. In fact, you may look at the current market and wonder if buying a home is the wise investment it once was. Our quick answer to this complex question is going to be an annoying “Yes and No.” But keep reading to find out why the long version might surprise you.

Going Up

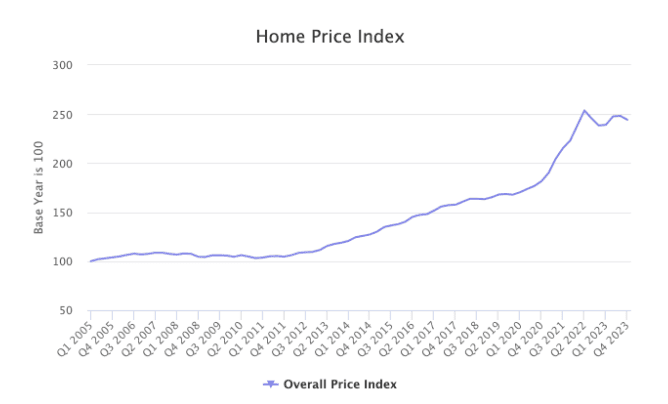

Webster’s Dictionary defines an investment as “the outlay of money usually for income or profit.” Ok, the “usually” part is not what you want to hear. We want every investment to be profitable. But if we could figure out how to control the market, then I suppose it wouldn’t be much of a market, would it? However, in contrast to many other investments, the value of homes have almost always trended upwards. Take a look at this index created by Texas A&M Real Estate Research Center. Other than a minor setback after the 2008 crash and a slight dip after the 2022 boom, prices in the DFW area have trended upwards over time.

As with all investments, you need to consider your expectations and whether or not they are reasonable. If you ask any wise investment professional the most important factor in an investment’s payoff, we are going to bet they will say time. If you expect to buy a house and turn around and sell it for a profit in one year, two years, or even three, you may be disappointed. But if you hold onto a home or investment property for years, the likelihood of you profiting off its sale will only increase. The longer you hold onto it, the higher the chances of a strong profit. In fact, did you know that we have not had a ten year period in which housing prices did not increase since the Great Depression? That’s pretty consistent data.

Calculating ROI

Let’s look at an example to make sense of it all. Stephanie buys a house with a selling price of $450,000. She is able to make a down payment of 20% ($90,000), which makes the loan amount $360,000. Let’s say she gets a mortgage rate of 7%. Here’s the part no one loves about borrowing money: once all of the closing documents are signed and Stephanie has the keys to the house, she now owes the lender the $360,000 plus a significant amount of interest. Interest may be a necessary evil, but it doesn’t have to stop Stephanie from making a profit on her home once she decides to sell it. Side note: Did you know that mortgage interest is tax deductible? Yup, that pesky interest you have to pay does have a benefit in offsetting your annual tax burden.

Using the following chart, we are going to calculate what return on investment (ROI) Stephanie could see on this home, depending on how long she chooses to keep it. We do not know the precise increase in home value. Overall, Fort Worth has seen more than a 200% increase in home values since 2000, but we do not see that escalation continuing. Instead, using the chart above, we will select a much more conservative appreciation rate of 2% each year (our guess is that this number could be much higher, but no one knows for sure how housing values will continue to increase).

As you look at the chart, pay attention to the increase in selling price over time (again, using that conservative 2% rate of increase) and keep in mind that we are subtracting the $90,000 down payment from earnings because that was part of the initial investment that Stephanie wants to see a return on. As the years pass, you will also notice that the loan balance decreases (because of Stephanie’s monthly payments). This, of course, widens the gap between the selling price and the amount still owed on the home and therefore increases Stephanie’s return. In contrast, the amount Stephanie would pay for a rental property does not add value or profit for her. It does for the property owner, whose mortgage on the investment property is decreasing thanks to her payments. There’s nothing wrong with renting, but Stephanie prefers the long-term investment of owning a home.

*This is without including other taxes and fees (such as homeowners insurance)

**Does not include interest

***Note: You will likely not pocket all of this “profit” as some will go towards closing costs or other fees associated with selling the home.

As you can see, Stephanie may make a tiny bit of profit if she sells after only one year. But most likely the amount she earns will go towards closing fees, leaving her with not much return on investment. However, if she can hold onto the home for three, five, or ten years, she looks to experience a fantastic ROI even at these conservative increases in property value. Of course, there is the chance that home values will decrease. But, as we’ve already stated, the trend over many years (particularly in our area) has been towards a consistent increase in value.

The Invisible ROI

Let’s go back to that definition of an investment: “the outlay of money usually for income or profit.” Here’s where buying a home is a little different (in contrast to other strict investments, including investments in property for purposes other than residing in it). When you are buying a home for you and perhaps your family, there are other outcomes you are likely hoping for. The truth is, we want a home because it gives us a setting for our lives, a haven to rest and create, a place to raise a family or offer hospitality. Though it may sound a little too warm and fuzzy, buying a home has always had an emotional component. And, in this way, it is far different than a traditional investment. You are investing a large amount of money, but for more than strictly income or profit. Actually, ask most of our agents and they would likely say that real estate would be a far simpler market if it were purely about financial payout. But it’s not. And it’s why most of our agents love their work. Buying a home is an investment in the kind of life you envision, the peace of mind you long for, and the hopes you have for the future. And that’s why it’s far more than simply a good or bad investment.

What’s Next?

Does the complexity of this feel overwhelming to you? To be honest, it’s one of the reasons we think LEAGUE agents are the best. They care about both your financial investment and the intangible investment you hope to make when buying a home. They are experienced and kind, trained experts on the real estate market and caring individuals – exactly who you want in your corner in making the best investment for you and the people you care about.

Call us today to start a conversation about what a good investment might look like for you!